Blog

Care is Much Better and More Affordable Because of the Affordable Care Act and We Should Build Now on Those Successes at Key Levels As A Nation Today

March 21, 2024

The Affordable Care Act (ACA) has made care better in America. It’s on the path to give us an excellent care agenda for the country that will end up with more affordable and continuously improving care as our basic care strategy and trajectory for the country.

Most people don’t know or understand what that agenda is or why that approach is succeeding at so many levels today. We’ll be better users of that resource and that content when we understand more clearly exactly what it is.

There are three key component parts to that approach and agenda. All three of those strategies have been extremely successful in their implementation for the country.

Covering low-income people was the first, highest, most important and most immediate priority for the overall Affordable Care Act and plan for the country.

We were delivering substandard and inadequate care to far too many of our low-income people when the law was passed and that was just wrong for us as a country and it was bad for the all of the people who needed better care.

The public and media debates about the Affordable Care Act and about the basic components of what is often called Obamacare have consistently focused overwhelmingly and almost exclusively on the issues relating to insurance deficiencies and insurance coverage problems and to a number of insurance-related inequities that we faced as a nation.

That was a legitimate initial high visibility focus on those insurance issues. The fact that people in this country with pre-existing medical conditions and no government or private employee plan coverage could be rejected as customers by insurance companies for those medical reasons, when those uninsured people wanted to buy coverage, was just plain wrong for us as a country. It needed to be fixed.

The insurance inequities were a very real and highly relevant issue.

The inequities deserved significant and direct attention for the country. Those issues deserved to be highly publicized, discussed, understood, condemned, and then corrected in putting together that health program package for the country that became the Affordable Care Act.

However, the truth is that when we look at the total scope and impact of the law — and when we look at the deficiencies that needed to be corrected at that point in time — those insurance issues actually affected fewer people than two other portions of the law that get less attention when we look at what happened there, and when we talk and write about the situation we were in.

When we looked at who was being damaged by the old approaches before the law changed, a far bigger problem for us as a country — when we look at the total context and look at the immediate life realities and care-related needs of our population — was the sad and undeniable fact that the clear majority of our lowest income people had no coverage at all.

We didn’t automatically cover our lowest income and our highest need people in most settings. We covered some, but even for the ones who had coverage, the standard Medicaid programs that we had in place in most states too often had some significant deficiencies in the availability of care and in the quality of care that existed for our patients in too many of their care sites.

The full and direct impact of the total Affordable Care Act law that deserves far more attention and credit than it usually gets in the media and in our public policy discussions about the ACA, is that the total program and the plan now covers many more low-income people who really needed that care, and actually now does it fairly well.

It covers our low-income people with far better care and that’s absolutely the right thing to do. It affects so many people who really need that help. Any country that now spends more than $4 trillion on care shouldn’t have any holes in its care fabric for people who need it the most.

Medicaid doesn’t get the respect it deserves in the political and functional Obamacare discussions or debates.

Look at the actual numbers. It now covers more than 90 million very real people.

The people who debate the Obamacare political issues — who talk in hypothetical and ideological terms about the possible repeal of the law in its current form — almost never look at, mention, or discuss the fact that we now have 90 million low-income people who are enrolled in a wide range of increasingly competent care systems who could and would be damaged in many ways by repealing that law. Those people clearly really need and deserve to have, and should be entitled to have, that care.

We’ve done that fairly well. We should be proud of what we’ve done. We should factor those realities into our discussions of the law and its impact on the country.

We Have Significantly Improved Care for Medicaid Patients

We’re actually now on the path to have some of the best care in the world for our lowest income people. The other countries that cover everyone in their country are now fairly far behind us, in the use of the computer tools and the data systems that improve care, that we use broadly for those patients now that we have our own new Medicaid programs and plans in place as the infrastructure that we use for our care.

We’ve probably gone from worst to best for our low-income people for some elements of care.

Care is improving for those people. We now have a new and growing culture of patient directed care extending through the plans that run the Medicaid programs and across the sites that deliver that care that’s now increasingly patient-focused, highly competent, directly available, and much more visible as care delivery to everyone who wants to look at those patients and those programs and see how they’re doing.

About 9 million of those patients are in the Children’s care enrollment. The care infrastructure that’s been created and implemented for those patients is at its highest level and at the most effective levels ever.

The states run the Medicaid program. Some of the states haven’t extended all of the available Medicaid coverage to all eligible people. That’s changing over time and that will probably continue to happen.

Progress is being made on that issue because the citizens of the states who haven’t extended Medicaid completely to all of their eligible people tend to want those programs for their patients. Voters are making it happen in some settings where the legislatures have been unwilling to act.

North Carolina just joined that approach with a legislative led program. They will now enroll 600,000 Medicaid members this month and they will deliver a full package of needed care to those enrollees very quickly and competently in ways that those patients very much want and need.

So that basic portion of Obamacare is very successful. We should celebrate those successes.

We Should Celebrate Medicaid Successes

The major achievements for that high-need population should be recognized, understood, and celebrated for the win that it clearly now is.

The states have all chosen to do some levels of managed care as a way of providing care to those Medicaid patients. We have far better and much more organized care for those 90 million patients everywhere that the programs have been rolled out.

The care is now functionally and clearly superior to what had been available in most settings from the old Medicaid programs and from the old fee-based payment approaches that existed everywhere before the ACA.

We have excellent and robust patient-focused care across the country. There’s also a new national culture of patient-centered care improvement in the plans that now have plans everywhere using and sharing best practices and implementing clearly patient-focused care models with the other caregivers and plans who are treating those patients.

That success has been almost completely invisible to the health care media, to participants in most health care policy academic settings, and to a significant portion of the political functions of our states and communities. No one has brought it to their attention and no one has explained to the media and policy settings what just happened.

So, the political debates have been locked into old rhetoric and currently irrelevant labels and information. The people who say they want to repeal Obamacare don’t have anyone explaining to them what Obamacare actually is, what it’s become, and what will be damaged or lost if the law was repealed.

It’s pretty easy to see, in a number of settings, how many things would be lost with that repeal.

If you visit and attend and observe the national and regular meetings of the relevant organizations now — meetings of the organizations that run the Medicaid programs and meetings of the people who run the Medicaid plans — you can see fairly easily that portion of the care infrastructure has a new skillset and a strong and continuously improving basic culture for much of their care and you can see that it’s feeling good about the care improvements they’re putting in place in so many settings.

Our news media doesn’t have a clue that it all happened. Far too many of our ideological health policy programs and settings have not kept up with the progress or the achievements in those areas. No one is explaining them to the world.

The health care media and a significant number of the health care policy settings aren’t dealing with the actual accomplishments and with the current potentials and achievements for those areas in their thinking, planning, and understanding of the health care reality we face as a country and what we should do now to build on what we now have in place.

We’re probably doing a better job with our lowest income populations than most of the countries who have universal coverage today because of our technological gains and our extensive and growing sets of innovations in that space and with those sets of tools.

Most of those countries with universal coverage for their people are just learning some levels of that care. We lead the world in the computerized tools that support our care. We’re using them in very effective ways for these programs.

Medicaid plans are clearly a leader in that area and those functions. They take pride in both sharing their successes and setting up the next levels of progress in the relevant sites of care. The industry has reason to celebrate how well we’ve done for 90 million very real people.

We Also Continuously Improve Care for Seniors

Our second major focus for the Affordable Care Act that we need to better understand, appreciate, and celebrate was our senior patients and the basic programs that provide Medicare coverage and care to the country that have also been continuously improving.

We have now made major progress in those areas for our seniors, because of the programs that the Affordable Care Act has incented and put in place using the Medicare Advantage plans, processes, and programs to deliver and improve benefits, and to manage the cost of care.

The ACA senior program has been a catalyst and very effective leader in that area. We now have better, less expensive care. We have much better benefits for a majority of our senior patients. The Affordable Care Act designed, launched, and now is anchored on the Medicare Advantage plans that now enroll more than half of our senior patients, and that all save money on care compared to the old highly inadequate approach that was projected and destined to create long-term insolvency for the entire Medicare program based on the losses it experienced every year.

We now spend less per person than we spent on the old care model with Medicare Advantage. We spend less in the plans because we’re delivering much better care to those patients — and better care costs less to the point where insolvency won’t happen for the program. The costs for those better patterns of care are lower than the costs are for the people who aren’t in the plans.

We’re now creating surpluses from the people who are enrolled in the plans and we’re making the program viable financially with that lower and better cost trajectory for those members.

Our classic and traditional Medicare program has run at a financial deficit every year. We have decades of financial deterioration for the Trust Fund as a result of the expenses from those members. The people who look at that traditional Medicare program and its costs predict with confidence that it will continue to deteriorate into the indefinite future. They say the trust fund will eventually run out of money because of those losses.

The policy people and the Medicare Trustee Commission members who look at the program, and who base their predictions completely and totally on the traditional Medicare enrollees’ cost trajectory, predict that the program will see the reserve levels for Medicare drop annually until the entire program becomes functionally insolvent and needs to be bailed out.

That’s no longer true or valid as a prediction for the Medicare program.

Medicare Advantage saved the day.

More than half of the total enrollees are now enrolled in Medicare Advantage plans. The plans cost less per member for their care now, because of the discounts in their bids that happen every year, which save money every month for those members. The lower cost plans also have a guaranteed lower rate of increase for future costs because they’re paid on a capitation basis instead of fees. CMS can completely control the amount that’s paid for capitation to the plans each year.

CMS can absolutely guarantee financial success for the program with the numbers they pick for that capitation payment to the plans.

The people who are deeply rooted critics and opponents of the Medicare Advantage plans invent numbers that tell the Medicare Trustees not to trust what appear to be significantly lower costs for the Medicare Advantage plans.

The critics say, there’s a future adjustment of 12 percent that will somehow happen to the Medicare costs and reserves that will make those savings disappear. The critics do magical thinking with that 12 percent future cost reduction, and they make it with no functional or possible way that they actually describe or explain or discuss or outline or show or enable in any possible process how that lower number will be relevant to any actual part of the payment process for Medicare.

They definitely believe and state that 12 percent adjustment will somehow happen. They say clearly and with apparent conviction that Medicare will suffer as a result when that adjustment happens.

In the real world, the plans base their capitation amount on the actual and current average cost of fee-for-service Medicare in every county.

That’s a solid program and those are real cost numbers that are reaffirmed and validated each year by Medicare from the trust fund processes.

The plans can receive that full average cost amount as their capitation payment each month if they choose to do so and — that will be their payment from the trust fund as their payment for care.

The plans don’t actually need the full average cost of fee-for-service Medicare every month for their payment level. So, they discount the bids to the levels that work best for the plans and for their future as health care programs.

The average discount for the plans this year was 17 percent.

So the plans receive 17 percent less each month than those same patients would’ve cost if they had continued to receive their care from traditional fee-for-service Medicare.

That payment level is enough for the plans to build much better care and much stronger benefits for their members. That discount is free money to Medicare that also creates dental, vision, and hearing benefits for the people who join the plans. Those expanded benefits have literally no cost to the Medicare trust fund. They come from the discounted capitation payment — and there’s no way of getting any additional Medicare money from that flow of cash.

The critics who invent their numbers and who invent their risk level distortion theories, accusations, and explicit contentions — who say that Medicare Advantage will bankrupt Medicare — now face the fact that the Medicare trust fund for 2022 grew by $83.4 billion rather than losing money.

The new reality is that the long-standing risk that the Medicare trust fund will deteriorate into insolvency based on the other programs in Medicare losing money has been completely offset, eliminated, and erased by the positive Medicare Advantage financial results and the care delivery performance of the plans.

The Medicare trustees have had a difficult time figuring out what is happening with all of the relevant numbers in the last couple of years.

The trustees have been confused about how to think about the Medicare Advantage program. They could see the lower costs that were happening at record levels for the plans, but the Medicare Advantage critics and a couple of the policy journals who’ve been committed to the concept that Medicare Advantage is somehow being significantly overpaid and will actually bankrupt Medicare with those payments — and they made that point in multiple, seemingly credible settings to the trustees and to the world.

That’s very confusing information about the path that Medicare is on.

So, the trustees have decided to duck the argument about those enrollees in the Medicare Advantage plans each year — and to not predict anything about that program for the immediate future.

The Medicare trustees have functionally decided to just wait to see what’s happening with the actual numbers and to look at the total costs emerging for the Medicare program with the deeply discounted bids from the plans — and have avoided taking a position on what was happening for the program with all of those factors in play.

The trustees reported the $83.4 billion surplus that Medicare experienced for their 2022 annual report. They explained it as reflecting and somehow being “lower costs than expected” for the expenses of the program, and they were silent in the report on the issue of “which costs were unexpectedly lower.”

The trustees did point out early in their report that the fastest growing part of the Medicare program was the part with people who were eligible for both Medicaid and Medicare coverage. They said that the people with that level of dual eligibility who joined the Medicare Advantage Special Needs Plans created a major cost reduction and advantage for the government when they left fee-for-service Medicare and joined the plans.

The trustees have been ducking the Medicare Advantage issues for years. They reported the overall numbers, but tended to leave the Medicare Advantage program out of their annual future-thinking strategy processes for the Medicare system each year.

That could be done for that report when Medicare Advantage was only a tiny part of the enrollment, but it’s now more than half of the enrollees. It actually, measurably costs less than the traditional Medicare care delivery program for each of those members — to the point that it’s changing the overall reserve levels for the entire Medicare program in a very positive and probably permanent way.

The Medicare Trustees — completely ignoring what’s been happening in the Medicare Advantage program, and with results based only on the continued performance expectations of those traditional fee-for-service Medicare programs — have been officially predicting that the losses that happen every year for those programs (and for the fee-for-service Medicare members) will continue indefinitely. They’re still predicting that those losses will probably cause the Medicare trust fund to continue to deteriorate and to ultimately become insolvent as a program roughly a decade from now.

This next report will be a massive change of direction for the Medicare trustees. They now have a secure future for the trust fund reserves with the additional $83.4 billion added to the reserves. They don’t need to predict and anticipate that the fund insolvency will happen at any point in time when that money is very real and in the Medicare bank. There’s no possible way of having it offset by the two decades of losses, which has been the normal pattern for the financial status of the program.

Not only do the Medicare Advantage members create a better future financial trajectory and a significant surplus for the overall program — we have now reached the point where the Accountable Care Organization (ACO) part of the strategy for seniors has enrolled large numbers of members. They also have better financial results than the other enrollees in traditional Medicare.

That part of the program will also be succeeding at important and positive levels that we can expect to see continue. It’s a major priority of the people who run CMS. They’re committed to having solid performance for those plans.

About half of the people who are still in fee-for-service Medicare have joined ACOs. Those members are also getting far better care than the average person enrolled in the traditional plan and care sites with no ACO linkages.

The best ACOs provide much better care. They tend to cost about 5 percent less than other fee-for-service members in their counties and care settings. Part of that $83.4 billion surplus and profit for the Medicare program comes from those members.

Like the old versions of Medicaid, our traditional Medicare program has a long history of inconsistent and too often bad care and constantly growing expenses — and a weak set of benefits that’s caused the average member to have more than $5000 of expenses each year — and to be one of the highest causes of financial insolvency in the country for our low-income people.

The old Medicare program has been particularly weak in delivering care and coverage to our lowest income, older members.

Traditional Medicare always buys care by the piece—and that purchasing model is flawed at multiple levels that are relatively easy to see when you look at what actually happens in the delivery of care.

The economic reality of that purchasing model is when you’re only paid fees for pieces of care, you can make more money when the care fails. You can also make more money when the patient has complications that lead to the need for more care that’s all purchased by the piece.

Each need for care creates a revenue source for the fee-for-service Medicare providers.

It’s like buying cars in a purchasing model that allows the car seller to increase the price if the car fails, and to double or triple the price of the car if it actually crashes or if the driver dies.

If that were our payment approach and the economic model we used for purchasing automobiles, the car industry would probably not make driver safety and collision avoidance a top priority.

The team that designed the ACA decided to use a completely different capitation-based payment model that they built into the Medicare Advantage program that funds patient care improvement and rewards the care teams financially when they have fewer hospitalizations and lower numbers of care crises.

Instead of encouraging failed care with financial rewards and with massive flows of cash for bad care outcomes and inefficient and dysfunctional processes, the Medicare Advantage payment model changes care to better outcomes and much lower levels of medical crises and complications.

Instead of a care model that has caregivers billing for billions of dollars in expensive and profitable amputations in direct payments of cash, the payment model for Medicare Advantage lets the care sites profit and create surplus cash flow when amputations aren’t needed because of better care by the care sites and the plans.

Amputations cost billions of dollars for Medicare each year. They were the only medical procedure that increased significantly during the first months of Covid — when procedures that billed more than $100,000 per patient could still be done in very profitable ways in the care sites, even with the Covid restrictions in place.

The plans know that 90 percent of amputations are caused by foot ulcers. That’s absolute, irrefutable, time tested, and proven science. The plans also know that you can reduce foot ulcers by over 60 percent with dry feet and clean socks. So, the plans do exactly that — and instead of the 30 percent levels of amputations that happen for patients in some of the lowest income settings, the national average for Medicare Advantage plans for amputations last year, across a wide proportion of the Medicare patients, was 1.3 percent of the diabetic patients treated by those care sites and getting that basic care in those settings.

That’s a very different payment model. Medicare Advantage pays capitation amounts for each patient rather than fees for each piece of care.

The capitation amount for the plans is based on the average cost of fee-for-service Medicare in every county. Their care in the plans ends up being significantly less expensive than those average fee-for-service costs in each county. The plans and their care teams have far fewer amputations, much lower levels of blindness, and significantly lower levels of congestive heart failure crises hospital admissions for the plans who have care team members assigned to patients and helping patients achieve those results.

They do a calculation at CMS (that’s constantly being refined) that determines the actual amount paid to each plan. That amount paid is based on the health condition, age, and gender of each patient to make sure the money goes to the right care teams for the patients.

That payment model has been continuously improving. It will continue to improve over time because that’s how the program is set up, and that’s how it’s being managed by the Medicare team at CMS.

It’s been increasingly and highly effective at paying the right amounts for the patients who enroll in the plans. So, the plans know what they’ll receive when they enroll their patients in each county. The highest need patients generate more capitation and create the opportunity to enhance the delivery of their care to cut their complications instead of their toes.

The plans all bid less than the average Medicare cost in each county. That lower bid is visible to the world and to the other care teams who are competing for those patients.

That capitation average payment to the plans is 17 percent lower today than the average cost of the fee-for-service care in all of the counties that use that capitation cash flow to pay for care.

It’s a very basic model.

The plans get the capitation each month from Medicare. They can use that money to deliver and manage care for their patients and they can do that in ways that aren’t tied to the old fee schedules for the delivery of care for those patients for the plan revenue.

The quality plan that is part of the Five Star program is carefully designed to incent, encourage, and steer better care as a key element of the Medicare Advantage program.

The Medicare Advantage program created explicit and intentional quality standards and performance goals that are constantly measured for the use of that money as a key and foundational part of the program — and to help create the better outcomes for the plans.

The people who set up the program knew that one of the biggest problems, expenses, and failures in care delivery was blindness for too many diabetic patients.

The team that created the Medicare Advantage quality standards knew that high blood sugar created many cases of blindness. So, the plans all have quality goals to reduce blood sugar levels and the functional reality is that those goals steer care delivery for the plans and end up with better and less expensive care for the patients.

Those five-star plan performance expectations for the plans and the care teams are very practical and effective goals. They’re based on medical science and on care engineering approaches and successes. They focus on the highest leverage processes that change the trajectories for care in positive and patient-focused ways.

It isn’t very complicated or hypothetical or speculative as a basic way of buying care. Practical components create the model.

You can reduce diabetic blindness by 60 percent by managing blood sugar levels for the patients.

That’s basic medical science.

All of the plans have those blood sugar management goals as part of their quality system. They’re overwhelmingly successful in meeting them because they’re so important for patient care and they steer important pieces of the care agenda across the wide range of care sites.

The plans all get paid a higher capitation when they achieve four or five ranking and levels for the star-based goals.

That seems to be the only governmental program in the world that actually pays more for better care. We know what all of the other countries do to buy care. None of them pay more for better care. The people who designed the ACA did a brilliant thing to include that factor in the payment model and to make it a new core expectation for care sites in this country. It affects so many care times and so many patients with those conditions.

We’re currently at the point in the care improvement process for Medicare Advantage plans where over 90 percent of the plans now manage to achieve their quality goals at the four- and five-star levels set up by the Medicare Advantage quality program. That means that care is better for many patients.

It also means that we have a new culture of care in America that’s intentionally managing and changing outcomes for care and generally celebrating being awarded four or five stars for their performance.

The folks who run plans and care sites celebrate those achievements. They know that it’s good for staff morale, staff self-esteem, staff solidarity, and joint efforts by members of staff when the team is focused on real and meaningful goals and then achieves them and can celebrate their successes together.

There are people at MedPac who have an amazing level of clear and painful incompetency in process improvement thinking and approaches who actually say that the plans shouldn’t have goals, but that each area should somehow have higher pay when care in the area improves. The MedPac opinionators believe that decoupling of goals from team performance is more appropriate for care processes. They recommend every year that those goals be ended and replaced. They say that there’s no reason to believe that managing blood sugar improves care when it’s a community target and process.

They’ve proposed that new area measurement approach regularly to Congress as a better way of setting quality goals for Medicare. They say that managing blood sugar isn’t really a legitimate goal, because too many plans can achieve it and that collective success makes it less relevant as a goal, so it should be eliminated.

Anyone who has run any kind of process improvement in the real world knows that it’s actually a huge win — not a deficiency or a failure — when you set a solid goal and then everyone actually and functionally manages to achieve it.

MedPac also says that the 17 percent discounts from the average cost of Medicare that create the much lower average cost of Medicare in every county should be ignored and not believed because they believe that the plans have somehow “upcoded” the data flow for the measurement process. They say that that upcoding is so significant and pervasive by the plans that we can ignore what seems to be much lower average costs for Medicare Advantage, because there is a “real” number that will somehow emerge from the process in some unclear and undefined way that they’ll uncover in some vague ways in future years.

They say every year that the “real” number will wipe out the record savings that the plans are all reporting based on spending less than the average costs of fee-for-service Medicare in every county. They also say using that their faith-based and entirely estimated adjustment number will turn those gains into losses, and will create major losses for Medicare as a total program.

Those die-hard critics could not be more wrong about the costs or the process or the conclusion they reach.

What they very directly and explicitly warn everyone about each year is actually, functionally impossible.

There’s absolutely no way that the “real” number they warn us about can possibly happen or be part of the cash flow for Medicare. CMS knows what they’re doing when they set all of those capitation numbers each year. They set the increase number for next year for Medicare Advantage plans at 4.3 percent, and they set it by edict from the CMS offices. It is absolutely what will happen for how much we pay plans.

That edict can’t be affected by anything that the plans actually might do with any coding thing that could possibly be done.

So, the current reality is that we’re receiving much better care for our Medicare patients that’s definitely less expensive than traditional Medicare for those same people.

The model we use today allows the plans to get paid less than the average cost of fee-for-service Medicare in every county, and the plans still make a profit on those patients from that lower average payment level by delivering significantly and measurable better care to their patients.

That’s the point that the Medicare Advantage critics totally miss or totally misrepresent in looking at the program and the plans. The plans bid less than the average cost of fee-for-service Medicare and they still create a profit and a surplus from that lower number and that surplus creates the money needed and used by the plans to improve plan benefits for all of the Medicare Advantage members.

Care costs less when fewer people go blind. Care costs a lot less when diabetics can avoid all of the hospitalizations that high blood sugar creates.

Lower costs allow the plans to make huge improvements in the benefits that are given to the members by the plans.

The Benefits are Far Better for Medicare Advantage Plans and They Don’t Increase Costs to Medicare

The people who designed the ACA set the program up so that the plans that create a surplus can use that surplus and profit to improve their benefit packages, better meet the customer needs, and increase their enrollment levels because people prefer the higher benefits.

That ability to use the surplus to improve benefits was a very good and powerful component to build into the program.

It’s worked extremely well.

The plans use their profits from better care to improve their benefits — and they have more members when that happens.

Fee-for-service Medicare has weak benefits. The average out-of-pocket for traditional Medicare patients is over $5000 each year — and they don’t cover hearing or vision benefits and any level of dental care.

The Medicare Advantage plans all use that profit, which is completely free to the Medicare trust fund, to offer vision, dental, and hearing benefits — and even some prescription drug benefits that are free to Medicare for some plans. They’re all paid for with the savings from better care — not from the Medicare trust fund.

The plans enhance their benefits to attract members. They give benefits that people need to make their lives better and to have better satisfaction levels for their entire package of care.

We have permanent better benefits and significantly lower costs for the plans. The money saved by not having people go blind can be used to provide vision benefits to the members, which is one of the reasons more than two thirds of the lowest income Medicare members have joined plans.

We’ve reached the point where the lower costs from the bids have actually created a surplus for the Medicare trust fund. Instead of the Medicare Advantage plans bankrupting Medicare as some of the critics repeatedly state and claim, the Medicare trust fund grew for the first time in decades.

The $84.3 billion surplus that was created for 2022 is saving Medicare rather than bankrupting it.

Medicare actually made a profit as a program last year.

It was completely unexpected by almost everyone in the health economics and policy world, because everyone listened to all of the critics who hate Medicare Advantage — who say with deep conviction and absolutely no actual calculations and measurements — that Medicare Advantage overpayments are bankrupting Medicare.

Those critics were absolutely, completely, irrevocably, massively, totally, and even stunningly and painfully wrong.

The problem has been that those critics were extremely credible to a large and growing number of people who believed their accusations and conclusions — because those critics seem so sure that they’re saying things that are true, and no one had access to the actual numbers that underlie and underpin the entire process.

Everyone just discovered instead that the 17 percent discounts from the average cost of fee-for-service Medicare that the plans very openly and clearly bid were as real and legitimate as they could be. Medicare Advantage created massive savings and surpluses and now program profits for the Medicare program because those bids were real.

No one expected that profit for the entire program to happen, but it was very real and it clearly happened.

Eighty-three point four billion dollars is a big number. It seems to be a permanent change in the financial reality for the program. It ends the decades of trust fund deterioration with a positive bang and it creates money needed by the program at the right time in the process.

This is the true number.

For 2022, with a majority of enrollees now in Medicare Advantage plans, the Medicare trust fund grew by $83.4 billion.

We ended two decades of trust fund losses, shrinkage, and deterioration with that extremely real and substantive current surplus. We should be able to make the new and better benefits a permanent part of the Medicare program. There’s no way for the Medicare Advantage capitation to rise to a level that will cause the trust fund to shrink again. CMS will never allow that to happen and they completely control those sets of numbers.

Medicare Now Has a Profitable Line of Business and a Financial Loser and a New Future

We need people to understand the basic business model for the Medicare program. It gets money every year from a defined set of sources, and we know exactly what they are and what they’re likely to be each year.

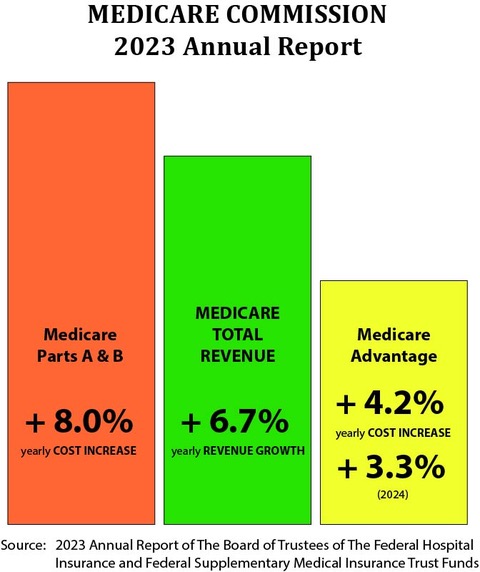

The basic and extremely important grounding and foundational financial reality is that the revenue for the overall Medicare program for all members is projected to grow at 6.7 percent per member each year.

If you think of Medicare as a total business, the trustees tell us that we can predict that the average revenue for members across all classes of membership is projected to grow at 6.7 percent each year. They currently believe and predict that number will be true and valid for a decade.

The Members enrolled in Medicare who aren’t in Medicare Advantage plans, and who are enrolled in Medicare Parts A and B, tend to have an 8 percent annual cost and expense increase each year.

Medicare loses money every year on those members with those cost increases because they exceed the 6.7 percent revenue increase for the total program membership.

The trustees — and the health economists and policy people — have been projecting each year that the trust fund reserves will be used up and spent by those losses until the program needs a financial bailout at some future point in time.

They generally predict that the current reserves for the Medicare program will last a decade. So, they warn us each year that we’ll need to bail out Medicare about a decade from now. And no one knows what that bailout might look like when it happens. They say our political leaders will need to make choices when that happens.

Some of the options could be painful politically and economically when we’re forced by that insolvency and financial inadequacy to change the trajectory of Medicare in some way.

They often predict and speculate that we’ll need to consider whether to make the Medicare enrollment smaller in some way to accommodate the deficiency in funding. Some suggest that we should change the enrollment ages and possibly start Medicare enrollment levels at age 66 or 67 to make up for the expected deficit in the program.

No one has been predicting or talking about what just happened.

The trust fund has been saved by Medicare Advantage.

We don’t need to look at options of making the enrollment age for the members older than 65.

This outcome was the functional and financial goal of the Affordable Care Act, but it’s been completely and totally unexpected by everyone in American government or health care. The critics of Medicare Advantage have been so persuasive and extremely negative that no one was considering it as a possibility.

Medicare Advantage, running at 17 percent average lower costs than the average cost of fee-for-service Medicare in every county, just created a very real and immediate surplus in the trust fund. That means that there’s absolutely no need to shrink Medicare in any way. We might even be able to reduce some Medicare costs.

We might be able to look at lowering the age for some new enrollees in ways that could be good for the country and for millions of people.

The prediction that the program is going to be insolvent is completely eased, erased, eliminated, and offset financially by the fact that the Medicare Advantage members now equal more than half of the members — and their costs aren’t increasing at that 8 percent level that would create future losses for the overall program.

The trustees have done their dire, negative, and grim predictions about the future of the reserves every year. However, they applied them only to Medicare Part A and Medicare Part B members. They completely left Medicare Advantage and Medicare Part C out of the picture.

They had no agreement or vision or alignment on what the future of that program would be with Medicare Advantage as a majority of the members. They had no steerage, predictions or strategies for those plans.

The most recent years have obviously had positive results on the cost trends for the Medicare Advantage plans, but the trustees have had no confidence in those numbers as their long-term consequence and approach. They believed the rhetoric and they believed the coordinated attack messages about possible over coding by the plans, which said clearly and directly that Medicare Advantage was overpaid and would bankrupt Medicare. So, they ignored the actual numbers from the plans at multiple levels.

They’ve said that, even though the Medicare Advantage cost increases for the past couple of years have been running at 4 percent and their official projection next year for those members is also 4 percent — they thought that was an outlier and would be replaced by much higher expense levels for those members.

They didn’t expect that 4 percent cost increase to continue. They also underestimated the number of people who would join the plans each year for the fifth straight year.

The trustees officially don’t expect that 4 percent cost increase for the plans to continue. Their official forecast has been that the Medicare Part A and Part B would continue to run at 8 percent of higher cost increases. They predicted that those same losses will be extended to Medicare Advantage members as well. They believed that the plan coding issues would somehow trigger higher cost increases for the plans than the ones they were seeing in the actual financial report.

They say that the trust fund reserves will shrink to insolvent levels in less than a decade if that cost trajectory for the entire program happens.

The trustees have been completely wrong on key numbers in that process. They said that trust fund solvency is still a major concern, but not an immediate one this year, and they delayed the insolvency timetable based on the current set of responses.

The key point for the trustees to recognize at this point in time is that Medicare is now two separate business models, and that they can expect future losses for one model, but should expect and achieve future gains in the other.

They did point out that the fastest growing portion of the Medicare program is the dual eligible part of the program. They said in the current report that a major financial goal for the program for 2022 came from the dual eligible members who joined Medicare Advantage.

The Medicare Advantage cost increases are continuing to increase at roughly 4 percent per member per year. That difference between the 6.7 percent revenue increase and the 4 percent cost increase creates a profit and a surplus for the trust fund from each and all of those members.

Nobody in the Media, the academic settings, or the health policy settings expected that to happen. It’s exactly what the payment model for Medicare Advantage was designed and set up to create. It should be a permanent win for Medicare. The program is based on capitation payments that are completely under the control of the CMS pricing team, and they will guarantee positive results as long as they don’t do something wrong or unfortunate to somehow impair or damage the plans.

The truth is that the Medicare Trust Fund made an $83.4 percent profit for 2022, because the 17 percent discounts are real and they saved Medicare by being real.

The plans should be able to create better benefits and better care. They should be able to create better jobs in many care sites by keeping that cash flow at the right and optimal levels for everyone in the process.

The Insurance Exchanges Are Growing Well — At Record High Enrollment

That’s two thirds of the key Obamacare component parts, and they are both doing well.

We’re seeing major successes for both Medicaid and Medicare as key parts of the ACA. We’ve also had major wins on the insurance reform part of that law and agenda as well.

When the media and the political people write about and discuss Obamacare, they usually focus on the insurance-related portions of the bill along with the pre-existing conditions and the insurance exchange opportunities that exist.

We’ve also had some significant successes in the third component of the ACA — health insurance reform. The public will want us to continue those successes into the future in the face of the attacks by people who want to kill or badly damage Obamacare and make that a continuing political agenda.

The ACA set up a new health insurance marketplace when the law passed that allows people who want to buy coverage, who don’t have employer-based care, and who aren’t in a core government program to purchase care and coverage directly from the insurance exchanges.

We just saw an enrollment increase in the insurance exchange market as well for this year.

We now have 20,000 people enrolled in those programs as of January of 2024. That’s a record high enrollment for that program.

Before the ACA passed, some insurance companies were able to make major levels of profit that some people in policy areas found objectionable and wrong. A number of insurance businesses in some markets were able to make 20–30 percent profits for part of their insurance business, and the people creating that law thought those numbers were excessive and wrong.

The insurers in those time frames before the law was passed were also able to exclude people from coverage if they had health problems or pre-existing conditions. That was a common practice for many of those companies, which sometimes made it difficult (or impossible) for people without an employer plan or a government program to buy coverage.

The ACA dealt with both of those issues.

It significantly and directly limited the profit levels of insurers. It created ways for people who needed coverage to get it, regardless of their pre-existing condition status.

The insurance purchasing exchanges that were set up in every state help those patients. More than 20 million people have enrolled in our exchanges.

The average profit level of the Medicare Advantage plans is now under 5 percent. It doesn’t resemble those old high, and sometimes inappropriate profit levels for some of the plans. That 5 percent margin is easily the lowest average profit level of any major American industry.

News media and various kinds of production companies aim upward of 20 percent for their average profits. Many stock companies in some industries promote the value of their stock based on profits that can sometimes exceed 100 percent of the core product price.

That relatively low 5 percent profit for the health insurers and the health plans is enough to keep the health plan industry well fed financially. There’s so much money in care that a low percentage in the profit area for that set of activities is still a lot of total dollars.

We have a total of 304 million people who had private health insurance last year. That number is running at steady levels from year to year. We still have far more people who get their coverage from their employers or from private insurers than we have enrolled in both Medicare and Medicaid.

That set of numbers looks very much like the numbers we see from Europe, where the health coverage for people is also almost entirely employment based and job linked.

All of those countries want to encourage employment. They also all want employers to pay part of the health expense for their employees, so they all use employer purchased coverage and employer linked health plans to create their universal coverage.

Most nongovernment coverage in our country is set up by employers in their own finances and cash flow as an employee benefit. That’s the same model they use in Germany, Switzerland, and the Netherlands, where every employer is required to offer health coverage to their employees. None of those countries use the Canadian single payer model.

That might be the biggest single misconception, error, and fake news component of both our health care news media and the American political debate about coverage and care. That debate in our country usually believes and assumes that the Canadian single payer model is used everywhere — but actually, no country on the European continent uses that specific model for providing health benefits or health coverage to their people.

That misconception might be the biggest single mistake and error we make in this country about health care and health coverage in the rest of the world.

The basic model we generally see, is that each of those countries actually currently use competing health plans to satisfy that requirement for their employees — and there are robust and competitive health plan markets functioning in each of those countries.

France uses a mixed model that looks a lot like our Medicare supplemental plan. Ninety percent of the French employers buy coverage from insurance companies to create more robust products than their thin basic plan. The rest of the countries use health plans that look very much like the Medicare Advantage plans we have in America to provide coverage to their workers and their families.

They call those competing health plans Sickness Funds in Germany. They were reportedly named by Chancellor Bismarck when he invented them and decided to use them to create health benefits for all Germans.

Canada does use that single-player model. It only uses actual health insurance plans for their prescription drug coverage. The provinces in Canada tend not to cover prescription drugs, even though the government does set the drug prices in most settings.

The Canadian government uses a fee-based payment program that looks just like the old Medicaid program in the US. They even use fee schedules that are within a couple percent of the current American Medicaid program prices to pay their caregivers for the care.

They manage to keep their total costs at 12 percent of their GDP using that Medicaid fee level approach. If they used our Medicare fee schedule instead of using our Medicaid fee schedule, they would see their total amount spent on health care in Canada increasing to 14 percent of the GDP.

That isn’t theory, conjecture, or hypothetical or political speculation. It’s basic arithmetic.

That’s how much more we spend on each piece of care for Medicare and Medicaid. Canada is subject to the basic laws of arithmetic calculations, and we all know what those fee schedules are and how much they pay now.

We would spend under 15 percent of our GDP on care if we used the Canadian fee schedule.

Our Three Payment Models Overlap in Key Areas

There are some very interesting opportunities that will be facing us going forward on our pricing and our care improvement agendas now, as the systems mature and evolve.

Most employers in our country who offer benefits to their members either buy insurance from an insurance company or plan, or choose to self-insure that risk and expense for their employees. We know what all of those purchasing approaches are now.

About 80 percent of the larger employers in our country choose to self-insure the coverage for their employees.

Those self-insured companies and employers tend to hire an administrator that pays their claims and administers their benefits.

That creates some overlap and some functional linkages and opportunities that our news media and our health policy world has no clue about. Our current status and approaches in those areas creates and sustains some parallels and alliances that have the potential to be very useful here in setting up those programs. That reality gives us a framework that we can use to help figure out our own future for both care financing and care delivery at a very large and possibly meaningful scale.

That overlap on care administration for Medicare and Medicaid and self-insurance programs can actually help us figure out where we go from here as a country for our care, with the full set of tools and linkages that we have available to us.

Over half of those self-insured companies hire an administrator who also runs a Medicare Advantage Plan and/or operates a Medicaid program of some kind in some settings and states.

Sheer logistics and functional realities tee up parallel and aligned behaviors in those areas. They create a result and functional reality that says the same diabetic care protocols that reduce blindness and amputations for Medicare Advantage plans are also used for the Medicaid enrollees, and for the self-insured patients supported by those administrators. That actually makes the care protocols set for the Medicare Advantage plans by CMS today very high-leverage and very high-influence in their broad and lasting impact on American patients and patterns of care across the country and into future years for our care settings.

That overall situation, and the current status of science and systems in the care delivery world, also means that we should realize and recognize that we’re clearly on the cusp of a golden age for care. We should not screw up this opportunity.

We have better diagnostic tools and better care coordination tools. We can use them to produce and deliver better care outcomes that can cost less.

The tools work better and they can actually deliver better care. We should, and we probably will, use them in every setting without that being a plan. We could do it even better if we’re very intentional in a couple parts of that process.

Artificial intelligence is going to make care much better and more patient-focused. We should be steering that process intentionally in good directions. The opportunities for major impact are so large and immediate.

Patient lives will be so much better when we go down that road and do it in intentional and designed ways.

So, we can now look at the ACA and we can say that it’s been an overwhelming success at multiple levels. We should understand what just happened for us with all of those parts and pieces of programs and care, and how to get even better at what we’re doing now.

We should figure out how to work from here to make the next stage even better.

We need to have an overview process that understands what has happened, looks at the health care system, and identifies the best ways of steering us to better care.

The people at CMS who set up the five-star plans for Medicare Advantage for use in 2025 should now understand that every care system in the country will be affected by the quality decisions they make for those programs and those plans.

They don’t need to micromanage the process that’s in place now. The current directions and goals and measurements in all of those areas are clearly good and functional today. They’re pointing us in some very good directions that have created a huge infrastructure of care tools and approaches that are aimed at achieving those goals. We will continue to be on some good trajectories if we change nothing in those areas for a couple of years and let the entire process settle into growing competency and interaction levels.

When you look at the national meetings that are set up to help support the work on care improvement that’s happening in the plans, there is a very strong set of activities pointing in those directions. Those efforts will improve every year, which is the nature of care improvement when you do it well.

Most people don’t realize that there are 82 quality of care requirements that are built into the law. These requirements deal with infection rates and care coordination linkages, and they’ve been transformational in a number of areas of care.

The Leapfrog Group – a coalition of employers focused on safety in American hospitals — just said that slightly more than half of the hospital CEOs in the country currently have achieving some of those safety goals built into their annual salary review process. That’s a high leverage impact on that issue. It clearly gets the leader’s attention when that link to personal income happens.

We would have much higher infection rates and lower system support for care quality in our hospitals without those requirements built into the Law as a foundational part of the package.

Obamacare is clearly a major winner at multiple levels. We can feel good that it’s in place.

We should understand it and we should appreciate it as an agenda, a package, an initiative, a payment system. We should see it as an opportunity for enhanced care into the indefinite future.

It works so well now at so many levels.

Medicaid alone is currently transformational. It should be celebrated for being very functional and directionally correct and directed at people who we should be helping every day.

We need to get the next levels right as a country to make care continuously more affordable and functionally better in all of those sites.

This is a good direction to be on.

Thank you, President Obama, for the legacy you and your competent, insightful, and highly strategic team created for all of these efforts for the country at so many levels.

We’re permanently in your debt.

And thank you CMS for continuing to improve how care is being delivered in all of these settings. Thank you for being so committed to using the entire tool kit to make care better for everyone — in both an inspirational and effective way. Thank you for leading us in the right way for the right reasons — and with the right support, leadership, and vision on those key points that anchor it all, for us all.

Well done.

Let’s take advantage of this opportunity to do absolutely great things. It’s actually possible for us to go down that road. It would be a mistake not to do it when it is so possible to do.