Medicare Advantage

Most people don’t know that Medicare Advantage has financially saved the Medicare program.

It also helps millions of low-income people with no pensions and no structured or supported retirement funds who get services from the plans that make their lives better at important and relevant levels after they retire and become, and continue to be, members of the plans.

Most people who look at Medicare Advantage as a program don’t know, understand, or even suspect the significant (and sometimes life-altering) impact that those additional Medicare Advantage benefits have on the lives of millions of our low-income retirees.

Medicare Advantage has also financially saved Medicare.

The basic and foundational payment system for the program was intentionally set up to guarantee that Medicare Advantage will cost less money than fee-for-service Medicare. It does that by having the plans bid capitation levels (for their members) that start with the average cost of fee-for-service Medicare in every county.

That payment approach uses the current average cost of fee-for-service Medicare in every county as the starting basis for the bids. That bid process for the plans is based on legitimate and trusted average costs in every county that show us accurately, each year, what the fee-for-service Medicare costs are for people in the traditional Medicare program in those settings.

The numbers that particular process develops and uses for the Medicare payment program are accurate, current, consistent, and highly credible as an accurate and legitimate measure of what Medicare costs are in every county now.

The plans look at those average cost levels for Medicare every year to build their bids. They look at their own cost structure and at their own expenses in each county. Then they decide on the capitation amount that Medicare will pay them with that current average cost information, in each county, as the context and the underpinning for their bidding process and cash flow for their payments each year.

When that capitation number from the plans is lower than the average cost of Medicare in each county, that means that Medicare has saved money on those Medicare Advantage members for that county because it’s spending less money for their care.

According to the current bidding reports — and in alignment with the relevant and historical bidding records for the counties and the plans — the plans are currently using capitation numbers for their bids that run about 11 percent below the current average Medicare costs.

The plans all bid some percent below the average cost of Medicare in each county each year. Those lower bids save money for Medicare. They also create surpluses for the plans that strengthen and maintain the Medicare Advantage program in each setting every year and they save money at the same time for the entire program by having those lower expense levels in place in so many settings.

The surpluses happen for the plans despite the lower bids, because fee-for-service Medicare has very high expense levels for many patients. Those high expenses are based on inferior, less effective and more expensive care (from fee-for-service Medicare) that creates those expenses for the Medicare program in every county and that create the opportunity for the lower bids by the plans when the bids are developed by the plans.

The plans know they can bid a lower amount than the average cost of Medicare in every county and still do well financially. That’s true because the plans provide much better care that costs less money. The plans can and do use that capitated cash flow from their bids to improve their care and their benefits significantly, and to very consistently make a profit at the same time. Better care can (and does) cost less money when it achieves that goal as the basic business model for the plans that anchors the Medicare Advantage program.

Bad Care Costs More Money

Most people who look at those issues and who look at the overall Medicare Program don’t realize, know, or understand that failed, flawed, inept, ineffective, and inadequate care happens for far too many fee-for-service patients and that bad care is a major expense of the Medicare program as it currently functions.

The functional truth and the cold economic reality is that the current fee-for-service piecework payment model used for Medicare actually encourages that bad care and often rewards it financially by paying more when care fails. That fee-based payment approach also far too often pays more to caregivers when inadequate and flawed care creates levels of complications for patients that trigger additional fees to those care sites who deliver and bill for the additional care pieces that are created by the flawed care for their patients.

This isn’t a hypothetical or theoretical concern.

Those outcomes and those very different patterns of costs and care for those sets of patients are extremely easy to see. They’re easy to see and easy to understand relative to basic elements of care for many patients for both fee-for-service Medicare and the plans when you just look at how care is delivered and look at what care is delivered to each set of patients.

Diabetic blindness is a major expense for fee-for-service Medicare. The people who built the quality system for Medicare Advantage knew that you could reduce diabetic blindness by more than 60 percent, simply by managing the blood sugar of diabetics.

That’s why a key goal for the five-star quality program for the plans is to manage blood sugar levels for diabetic patients. Ninety percent of the hundreds of plans, and many thousands of care sites for Medicare Advantage members, now achieve those goals for their diabetic patients. That success has the desired impact for those patients that caused that approach to become a goal of the process when the quality goals were created — and significant money is saved for those patients because the processes work.

Most fee-for-service care sites who now see low-income diabetic patients fail badly with that care. Those sites incur major expenses for those patients. That high level of expenses for those patients increases the average cost of fee-for-service care for the bidding process for the plans every year.

When the plans manage blood sugar in diabetic patients — and when they have a capitation payment opportunity and cash flow level that’s based on the high average cost of care for the visually impaired patients and for the optically damaged fee-for-service patients (who don’t get that better care from a plan), then the plans consistently save money for those patients with better and less expensive outcomes for their care and many fewer people go blind.

Plan Surpluses Create Better Benefits for Members

The Plans can, and they must, use that savings from those patients to increase benefits for their members under the terms, agreements, and expectations of the Medicare Advantage contracts that we now use to pay the plans.

The additional benefits that exist for the plans are a major win for those who enroll. It’s a much better and more effective use of the Medicare dollar for the entire program than just buying pieces of care.

The plan savings and surpluses are used to increase benefits for plan members. It allows the plans to create far better benefits than pure fee-for-service Medicare patients receive from their sites of care.

Average out-of-pocket direct expenses for traditional fee-for-service Medicare enrollees currently exceed $5000 per member per year — and the benefits for those members are much weaker in many areas of care, in spite of that additional expense that they pay for their basic Medicare plan today.

We need everyone looking at the program to know and understand that plan savings and surpluses are used to increase benefits for the members and not to simply increase profit levels for plans. Having better benefits is an important achievement and as significant win for the Medicare Advantage program, because the members have better and easier lives when those benefits are in place. Those better benefits can and do change lives in a number of ways that tend to be invisible to the media and to the policy people and health care academics who look at the Medicare program with narrow vision about what is actually happening there for the members in the plans and who don’t think of the needs of the members as the highest priority for thinking about the use of Medicare resources.

The higher benefits clearly encourage more people to enroll in the plans. The better and richer benefits are a major reason why a majority of Medicare members and a huge majority of the lowest income Medicare members are now in plans, and why that majority membership for the plans is likely to grow in future years.

Many Medicare Advantage enrollees have very little money and those enrollees need those benefits to help with some basic elements of functionality and wellbeing.

Low-income people with mouth pain far too often have no other caregivers providing dental care in their time of need, and those patients often have a sense that being free of that pain and actually having that care available to them when they need it is good and a major value from their plan.

The low-income people with mouth pain, and no other available care sites easily available to them, tend to value that dental benefit at a very personal and direct level.

Those members with that need tend to value, understand, and appreciate that related support from their Medicare Advantage plan. They give very high satisfaction levels when they rate their plans and rate their care sites in the annual measurements of the Medicare Advantage experience that happens every year and is very visible to everyone looking at the program.

The program’s original designers — who very much wanted the Medicare benefit package to be significantly better than the traditional, original program benefits — created a very effective and high-value way of using capitation payments and using the actual plan profits to improve benefits for the members.

The business model for the program is that profits for the plans basically come from better care.

That’s an extremely important and highly relevant piece of information that almost none of the health care policy people, or any of the health care news media who cover Medicare Advantage plans, now understand at any level.

The media in particular tends to have a very weak understanding of how that entire process works or how important the quality differences are to the country and to the people in the plans.

The quality differences are huge, and they fund the process and anchor the business model for the plans.

The plans have more than 30 percent fewer emergency room visits. The plans have more than 40 percent fewer hospital visits for asthma patients and for congestive heart failure patients.

The plans and their care teams avoid many painful, life-threatening crises and emergency room visits for many patients with those painful and damaging conditions by having those programs and processes in place that make patients’ lives so much better at very real levels for so many people.

The reductions in those hospital use levels all come from care teams and from caregivers identifying the highest risk patients as soon as they enroll in the plans. They then use competent functionality and patient-focused direct interactions and services with the patients to improve their care before each of those crisis processes start — and before they occur for the patients-- who would otherwise need that additional care and who would suffer accordingly in multiple ways that are far too obvious as factors in their lives when that care isn’t there.

The much higher number of crises that continue today in too many settings for fee-for-service Medicare patients (for both congestive heart failure and for asthma care) tend to increase the total cost of fee-for-service Medicare in every county. That cost impact and the much higher costs for those patients creates the capitation funding opportunity in every county for the plans.

The better care in those key areas tees up the 11 percent pattern of care cost reduction for those members.

That 11 percent lower cost that does happen across a wide range of settings is the direct result of better care intentionally created by the plans and it is not, somehow, created for the plans by either upcoding any data or by somehow skimming risk—and some Medicare Advantage critics charge and describe as the reason for the plans to have the surpluses that they have in every state.

Those lower costs and the consistent and widespread lower use of money for those patients was created by better care for the plan members.

Foot Ulcers Trigger 90 Percent of Amputations

Amputations are an absolutely important, significant, and obvious area where capitation supports better care and creates better lives. The care delivered to those high-risk and high-need patients proves the point that making care better saves money as well as saves (and even transforms) lives. Reducing amputations for diabetic patients very significantly lowers the costs of care for the program and for the country. Better care for those patients costs less money most of the time.

Amputations cost fee-for-service Medicare billions of dollars. They can be over a $100,000 for each patient. They’re a major cost for the fee-for-service Medicare program and they are often a major profit and regular high impact revenue source for caregivers.

The plans all know that 90 percent of amputations are caused by foot ulcers. They know you can reduce those ulcers by more than 60 percent with dry feet and clean socks.

The plans take care of those diabetic patients with dry feet and clean socks. They include clean feet and direct support for their care.

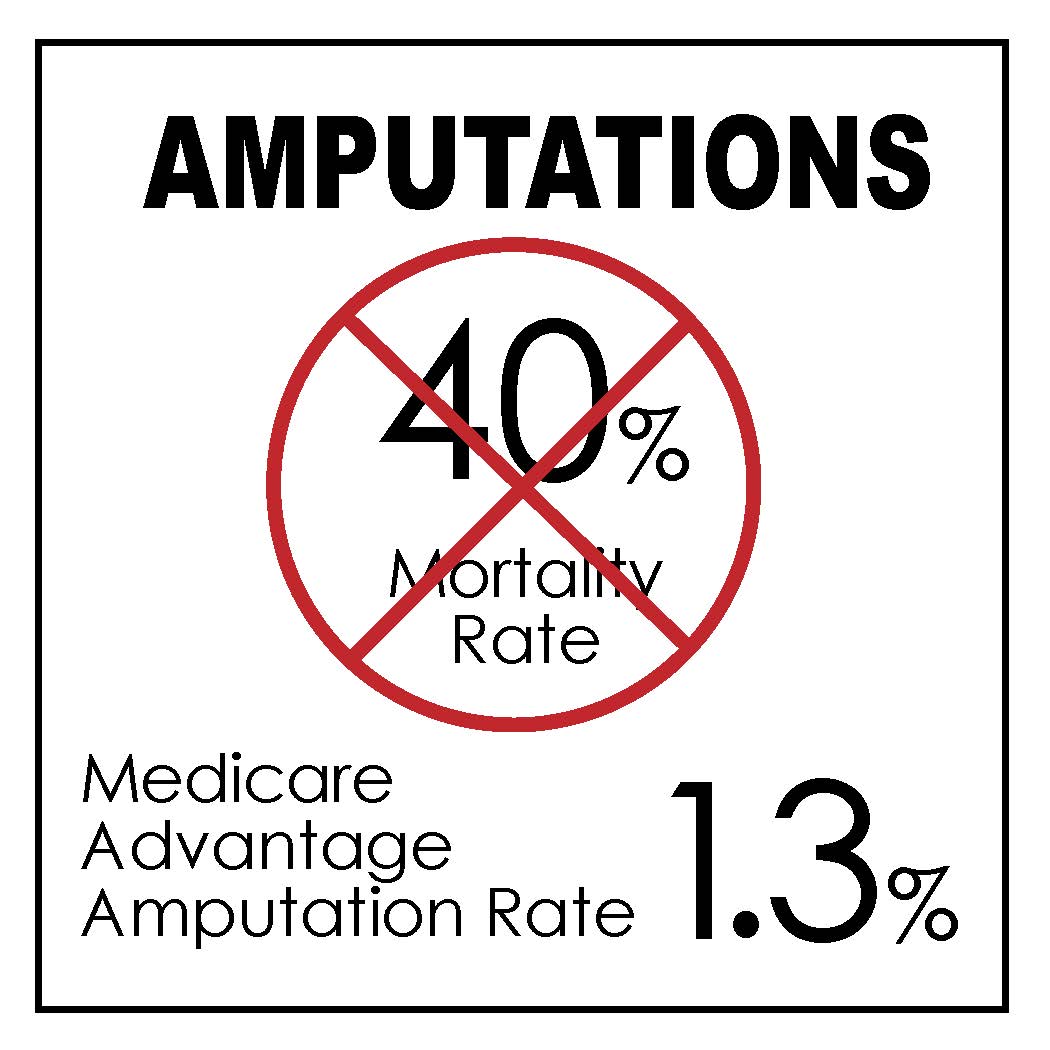

The plans are extremely successful with their treatment and with their care approaches for amputations. Instead of having more than 10 percent of those diabetic patients at risk for that very damaging and expensive outcome — and a 40 percent five-year death rate for those patients — the Medicare Advantage amputation rates are now below 2 percent. The amputation levels for diabetic patients now run at only 1.3 percent — in the thousands of computerized care sites who are enrolled in Medicare Advantage and who get that care.

The lives of people are extremely different when care fails and amputations become needed. Those people are in misery, pain, and fear for their lives. They have very unfortunate interactions with the world at multiple levels when they go down that amputation path.

The survival rates are much higher for plan members because of that better care.

The quality of life for Medicare Advantage members is far higher for many members because of those care improvement. The people who end up with amputations have over a 40 percent higher mortality rate in the next five years after they have the amputations. Those patients go through great misery and damage during that time — and dying might seem to be the lesser problem for people with multiple follow-up operations after the surgery and very difficult and unfortunate lives when they don’t get the care from the plans that allowed them to avoid that entire amputation cycle.

The same exact set of horrible, terrible, painful, and damaging things can happen for the congestive heart failure patients who don’t get the heart failure support from the plans and end up badly damaged or dead.

Many of the Medicare Advantage critics completely ignore the extreme damage in a person’s life that can happen after an amputation or after both extensive Ashma attacks and major congestive heart failure crises. MedPac carefully ignores and avoids any mention of the extreme differences in the life experiences of the people who do not get that support from their Medicare Advangage plan.

The 40 percent higher death rate is absolutely solid data and it should be a top priority for both the health care Media and the health care policy makers who are wondering whether the care differences for many members of the Medicare Advantage plans are relevant to our thinking as a country.

The special needs plan people are getting some of the first team care in their life — and we need people who care about the lives of other people to support that program and those agendas, and we need those people to stop saying repeatedly in multiple settings that the plans exist to raise and inflate codes and not to deliver care.

The costs are obviously much lower for those patients who don’t need the amputations. Those lower costs for those members create the surpluses that pay for the additional benefits for plan members.

Patients with better care have better lives for a wide range of health conditions, and we should understand that and promote those achievements as we look at what Medicare Advantage is doing in all of those five star settings.

The plans with better care for their patients in all of those areas bid below the average cost of Medicare in every county. Those lower bids set up the cash flow for the program and still enhance the benefits for their members.

Lower Costs and Lower Cost Increases Each Year Both Save Medicare

We now make a surplus on the overall Medicare program because Medicare Advantage has over half of the members and because Medicare Advantage costs less money per member.

Saving Medicare (and doing it with Medicare Advantage instead of drastic and heroic measures of some kind) means that we can now avoid the massive political battles about saving and funding the Medicare program that we’ve all been expecting to happen as part of our political future as a country. Those conflicts and those battles (that many people have been anticipating and creating political stress about) are not needed.

The current bids that create lower costs for the plans now, in every setting, make the average actual cost of care about 11 percent lower for the plans than the fee-based costs for the Medicare members in every county. So, we’ll never need to have the political battle about protecting our old people from the bad policies of the other party that most pundits have been predicting for our future political reality and context.

Future costs for those members who are enrolled in Medicare Advantage plans will increase at a relatively low rate. The increases in costs for those members of Medicare Advantage plans will be lower than the annual growth rate in total Medicare income per member, which we can now expect as a country and anticipate being our reality for this decade.

The Medicare program grows in total revenue per member by 6.7 percent each year. The Medicare trust fund gives us that number as a baseline for the program. It predicts that that number will be our growth rate for the next decade if we stay on the path we’re on now.

When yearly cost increases for the Medicare Advantage plans fall below that revenue increase number, Medicare makes a functional profit on those members with the lower costs.

That 6.7 percent annual revenue growth functionally creates the cash flow that creates the Medicare reserves, which sets up the overall financial context and status for the entire program each year.

Medicare Advantage is now profitable and the overall Medicare program reserves will now stabilize and grow because of those numbers.

Nobody Expected This to Happen

Almost no one in most policy circles or in the news media expected this to happen.

It actually was the explicit and intended goal of the people who designed the Affordable Care Act for this to happen, for us as a nation, when Medicare Advantage became the majority of the enrollment and when the plans had decades of bids below the average cost of fee-for-service Medicare in every county as the basic payment rate. That cost created a basic level of cash flow for the plans that’s an anchor of the Medicare budget and financial result every year. It gives us the core for our future costs and permanent success as a program — if we keep that total cost below the revenue increase level for Medicare.

The Medicare Advantage designers believed this result (having Medicare Advantage save Medicare) would be achieved with that payment model for Medicare once it achieved sufficient enrollment growth to make that outcome happen. The bids every year have been below the average cost of fee-for-service Medicare in every county, because of better care. We can all see what those numbers are and have been.

But no one believed them.

Everyone in most policy settings and in most media settings believed that Medicare would somehow, as a program, continue to fail.

That trust fund insolvency and deterioration won’t happen now because we’re on the right path for Medicare Advantage to continue to save the program.

We should be able to sustain this positive trajectory forever unless we do something really wrong to screw it up.

There are people who hate the Medicare Advantage program at almost emotional and often obsessional levels. Those enemies have tried many times in many ways to damage various parts of the program. They haven’t succeeded in their efforts because the bidding process has been so clearly linked, each year, to the average cost of fee-for-service Medicare, using real numbers and using actual bids from the plans that reflected lower cost trajectories for the last decade for the plans, that the momentum of those successes have prevailed over their attempts to do damage.

But we’re at risk now.

The enemies of that program have grown in strength in some settings. Some are trying to hurt the program now in various ways and they are trying to get Congressional support for their attacks on plans to weaken what they are doing in all of those areas. They’re trying to create allies for their negative approaches by saying things that are functionally false, but that feel true to some people who hear them and who are in positions of influence because some of the people saying them have personal credibility in some other areas of their lives.

We need to stop those people from damaging the Medicare Advantage program now at this highly important point in the process where we make the plans our new expectation as a country for care delivery and care.

The critics hate the program so badly and so openly that we’re at risk of them doing something stupid and deceitful and damaging to impair the successes we’ve achieved up to this point in time. We know they will try to do that because they say, and they believe that any solution for the country that uses health plans as a key component and tool of the process is evil and wrong and must somehow be stopped by any means.

We’re at risk of having some damage happen to the program because those enemies are reacting from a level of ideological hatred and negative inter group tribal thinking at a highly political and damaging level. They believe that plans and insurers are actually enemies of the people. They say and write that anything they now personally do to an enemy is a legitimate thing to do as a standalone set of values and behaviors because the alternative to their proposals is to have Evil win for us as a country and to have evil become the foundation for our system of benefits and care.

It Would Be Evil, Unkind, Disrespectful, Cruel and Even Immoral to Take Functional and Life-Altering Benefits Away from Low-Income People

It actually would be functionally evil and morally and ethically wrong at several levels for those people who hate the program with so much energy and conviction to do that benefit reduction and achieve that service level elimination damage today to those high-need and very low income people, but the people with that agenda clearly want to do it, so we’re at risk today of having it done now.

The critics who want to do that damage pretend they don’t know and that we should not care or understand who has actually enrolled in the plans in their focused and intense hatred of the insurers who run many of the plans and in their attempt to make benefits disappear for those members.

Eighty percent of our very lowest income Medicare members are in plans today. Most of the members from the Hispanic and African American membership have only a few thousand dollars in financial reserves in their retirement years, and have almost no money to spend on the various services and benefits that are now included in the plans for the members.

More than half of our Hispanic retirees have absolutely no retirement savings today.

The truth is that the lowest income retirees we have today as a nation need the full set of benefits from the plans so that their lives can function normally in their retirement years and so they do not face functional deficits for some basic services and elements of care that make day to day living less dysfunctional and less deprived for some key areas of services that we should all be able to take for granted in our lives.

Most health care economists and almost all health care media sites who discuss the Medicare Advantage benefit package have completely and totally missed the point of what just happened for the Medicare program and for Medicare Advantage and most of the health care economists and health care news media and social news media sources have no idea which patients are most affected by that program and by those benefits and need them in their lives. The policy thinkers don’t know how important it is to many of our lowest income people to have those benefits in place to make challenging aspect of their lives less painful and damaging.

Too many media and policy people believe the false but unfortunately credible critics who say, in multiple settings, that Medicare Advantage is a cost burden to Medicare instead of an overwhelming benefit to the members, and they don’t make the fact that the additional benefits create no costs and zero expense for the Medicare trust fund itself a key part of their information that they share about the program.

CMS is not part of the problem.

CMS is now running the Medicare Advantage program extremely well.

They’re guiding the finances to a perpetual level of success, and they are doing it with great levels of competence as part of the process.

The 11–17 percent health plan discounts for the bids, which create the surpluses for the program, keep the Medicare Advantage payments lower per member in every county in real dollars and actual costs. That level of success gives CMS a very strong reason to want the plans to succeed.

The Medicare trust fund actually made $84.3 billion for 2023.

The costs created by the plans (using those bids and offering much better and less expensive care) pulled costs out of the other Medicare programs and reduced it for the members of the plans.

When the Medicare Advantage expenses increase by less than that 6.7 percent, it’s very good for the programand the trust fund. Medicare creates a surplus in reserves from that lower number.

CMS now calculates and determines those numbers for the plans each year in ways that can’t be manipulated, upcoded, or distorted in any way to create a wrong set of numbers for the payments.

They pay the plans competently and well.

CMS Set a Lower Increase Level for 2025

CMS set up the payment levels for 2025 for the plans.

Everyone who wants to understand how and why this overall payment process works so well should read the CMS report for the 2025 payment levels that they share with the world to explain what they’ve done and how they’ve done it.

We know from the April 1, 2024 report that CMS, once again, did a solid job of gathering legitimate, credible, current, and real-time risk-level information about the members from the care sites, as a basis for those numbers. They used that solid and trusted process as foundation for the payments for the next year.

The CMS team, again, as they have been doing since 2020, used the encounter reports for each piece of care as the functional and actual source of information regarding procedures and diagnosis for each patient. We know from years of continuously improving use and refinement that the system now provides extremely useful, accurate, and timely information about each member to the payment process, and we know we can trust that set of calculations and reports to anchor it all for the current payment levels.

The program has a payment formula that uses basic patient-centered information on age, sex, and current diagnosis information to determine how much the plans are paid for each member. That information is now absolutely solid and accurate for those members. The CMS team improve the process each year and it’s highly accurate, current, and credible now.

The capitation amount for the plans is based on a formula that’s intended to reflect the risk levels of the members. The money and that flow of cash can be used by the plans in flexible ways that don’t reflect that set of fees, but that do pay for things that the plans believe work for the patients.

The care is much better in the plans. The benefits need to be protected and enhanced from this point forward, rather than being challenged by the people who oppose the plans.

The additional benefits that have been created by the plans are significantly undervalued and underappreciated by both the policy community and the news media.

Those additional benefits for dental care, vision care, and hearing care — and for many levels of social service support care — have a very positive impact on the lives of millions of people who are plan members today. That positive impact from those expanded benefits happens every day for the people enrolled in the plans. It would be a significant disservice to those members to have those benefits reduced or eliminated, as some of the critics propose and try to achieve.

The Special Needs Plan patients deserve our focus, attention and understanding as an anchor for the entire process. They’re at the very top of the enrolled population that need the additional benefits because they clearly help to change their lives.

We very much need everyone looking at Medicare to know how important that special needs program is to the people who are enrolled in it and now many of the prior inequities in care delivery over the lifetime of those members and patients are softened and addressed by having that program in place.

Special Needs Plans Provide Extremely Important Care for 6.5 Million People

The biggest, most direct, most obvious, and most powerful positive care impact for the plans and for the members they serve — an impact that deserves much more attention and a higher level of understanding than it currently receives from either the news media or from far too many health care policy folks — comes from the very low-income and very high-need people who are eligible for both Medicare and Medicaid and who join Medicare Advantage Special Needs Plans for their coverage and care.

The Special Needs Plans are game changing and life altering in obvious ways for millions of people.

The patients who are eligible for both the Medicare and Medicaid programs today have generally been damaged their entire lives by various social determinants of care-related inequities, inadequacies, insufficiencies, and even by too many basic incompetencies for both their health levels and their actual care.

Patients with those conditions have a higher death rate. They tend to have major levels of high-need care that make their lives difficult and often painful, dysfunctional, and even frightening. Patients in that program who live in our communities now, as Medicare Advantage members, are getting some of the best care and services of their lives.

They’ve been badly damaged by the care levels in far too many settings. Many of those patients have no one other than their Medicare Advantage plans doing the right things to make their lives better.

There were 5 million of those patients in the system a year ago. The enrollment level has now climbed to more than 6.5 million people in January of 2024.

There is no other program in the country that directly and intentionally recruits and then welcomes and supports those high-need patients (in both the Medicaid and Medicare programs) into Special Needs Plans and then gives them team care and much better sets of support and clearly higher levels of benefits that begin for each member as soon as they enroll in the program and join a plan.

The care can be so much better for those previously underserved patients that the Medicare Advantage Special Needs Program is often the first patient-focused and the first collaborative and functional team care that those high-need patients have ever seen in their entire lives.

MedPac Invents a 12 Percent Overpayment Expense

The Medicare Advantage critics (who do their amazingly and consistently hostile, uninformed, and painfully inaccurate description of how the Medicare Advantage plans get paid and function — and who sometimes accuse the plans of avoiding high-risk people, and of trying to skim risk in the enrollment process) are careful to never mention or acknowledge the 6.5 million very real people with extreme and extensive medical needs who are enrolled in the special needs program now and who benefit hugely every day from that care.

They’re careful to never mention the 6.5 million special needs plan patients, even though they know they exist.

They clearly know that they exist because they’re the fastest growing segment of the total enrollment in the Medicare Advantage program. The Medicare trustees and CMS both love those special needs programs because they change so many lives in so many positive and beneficial ways for millions of people. Those critics and the MedPac report writers who speculate on over payment levels only make their shamelessly false and inaccurate attacks on the plans for somehow being overpaid by Medicare as beliefs—and not actual data points-- and they pretend that those millions of patients do not exist because they obviously prove that the MedPac accusations on the plan payment levels and selection processes are wrong.

They don’t give any clue how the plans could enroll over 6 million high-risk and high-need people — and they somehow actually profit from the risk selection done by the plans that they actually say repeatedly in their attacks is the “primary business model” of the plans.

They completely ignore the fact that the amputation rates in the plans are far below the amputation rates in the traditional care programs and fee-for-service care sites that they promote as places for people to enroll.

Their annual overpayment attack on the plans has no functionality, reality, substance, data, or actual reports to support those numbers at any level. Yet, they continue to use it to attack plans.

They say in those attacks that, even though the plans appear to be doing great work, and even though the plans visibly cost less money — the positive and highly visible beneficial outcome for the plans in those areas shouldn’t be used or trusted until people factor in the MedPac 12 percent (pure fake news) overpayment that they claim each year somehow offsets everything and all other numbers in evaluating plans.

The truth isn’t relevant to them for that set of points, even when the truth and the actual numbers for the cost levels and increases are available in plain sight and being used to pay the plans. The truth and the actual payment numbers that are being used to price and pay the plans each year are known to everyone relevant to the process. CMS publishes the fact that the actual increase for the plans for 2025 is now under 4 percent — not the MedPac 12 percent estimate number.

The real numbers from CMS show and prove that the payment increase allowed and determined for Medicare Advantage plans in 2025 is only 3.3 percent.

Current data shows that the actual Medicare Advantage costs from the deeply discounted bids run 11–17 points per member below the average fee-for-service numbers for every county, which set up the maximum level for the bids each year.

Those lower costs have saved the trust fund for Medicare.

The Medicare Advantage sets of benefits are a major, and even massive, improvement over the fee-for-service Medicare program. We all need to understand, appreciate, and know that it can make a major (and sometimes life altering) difference for the lowest income members of the plans to have those benefits — from the Medicare Advantage plans — in place.

The Plans Have Vision, Dental, and Hearing Benefits that Don’t Exist for Traditional Medicare

We need to understand how extremely important the Medicare Advantage additional benefits are to our lowest income retirees. People’s lives are affected by the millions every day. We should care about that situation when millions of people are affected significantly and now by those benefits.

The plans have dental, hearing, and vision benefits that do not exist at any level for Fee-for-service Medicare. The plans pay for the additional and very relevant vision benefits by managing the blood sugar levels of patients. They reduce the rates of blindness by 60 percent with blood sugar control. They save money for Medicare by reducing the number of patients who need that most critical and expensive level of care for their eyes.

Those additional benefits from the plans are all completely free to the Medicare trust fund.

They’re created by bids that typically run 17 percent below the cost of fee-for-service Medicare. The benefits are paid for by the lower costs of better care and effective operations of the plans. The plans save money with that lower payment level.

The cost of those very important, useful, positive, significantly needed, game-changing, and much-appreciated additional benefits isn’t a trust fund expense at any level.

The Lowest Income People with No Pensions Need Better Benefits

We need to look at retirees as a population that we care about today and now.

A very important related issue about our oldest population as a country, is that the US now has serious problems. We have very real, financially painful deficiencies with pensions and retirement benefits for millions of our retirees.

People used to retire with a pension that paid a significant monthly amount each to each retiree.

The retirement expectation that existed two decades ago, for many workers, was that you would work a long career and then have a useful and well-funded retirement plan through your employer that made your retirement years easier and better.

That level of retirement financial support has definitely and unfortunately changed for the worse for far too many people.

Most employers have gotten out of the full pension business.

Barely half of employers today offer any retirement benefits at all.

We have about 53 percent of our workers participating in a workplace retirement plan and only about 11 percent of our private sector workers still get traditional pension payments.

The grim reality we face is that more than half of our retirees have some form of deferred compensation plan — like a 401(k) — that gives the workers some additional benefits and support — but almost half of those workers today have no retirement benefits at all.

That leaves many people with very weak retirement benefits and with some difficult logistical and functional issues for their retirement years.

The people enrolled in the Medicare Advantage Special needs plans have a fairly robust set of services and benefits that come with the special coverage for that program. Those services from the plans for those 6.5 million members supplement and provide some of the kinds of support needs for those members, in the home, that would be funded from a well-funded pension or deferred compensation plan for some retirees — if that traditional pension approach existed for them.

We should all learn, recognize, and realize that our basic and standard Medicare Advantage program actually helps with some of those issues for millions of people, whose lives are better in several areas because of their enrollment in plans.

Millions of retirees, who don’t participate in those more complete benefit plans for the special needs patients but who are enrolled in other Medicare Advantage plans, do actually have some plan-related benefits that are very useful and that make their lives easier (and even less painful in a number of ways).

Those plan-related benefits can help deal with some of the routine costs of life expenses that people encounter by surviving and by functioning in our communities today.

Vision, Hearing, and Dental Benefits Can Be Particularly Important to Low-Income People

The vision, hearing, and dental benefits from Medicare Advantage plans are sometimes the only financial support in those areas for the people now enrolled in the Medicare Advantage plans. Roughly half of the retirees in our country today have no pension or retirement funding at any level.

That funding deficit tends to be even greater for our lowest income retirees who disproportionally join the Medicare Advantage program to get some levels of that direct support from the plans they join.

We need people looking at Medicare Advantage as a program. We need people thinking about Medicare Advantage to understand that that reality exists for many members. We need to understand and appreciate that those patterns of resources and those needs for support happen for millions, because they’re enrolled in plans and often have no other resource for those years of their lives, other than their linkage to their plan.

The enrollment numbers for the program show that to be true.

Those needs and those resource levels are a major reason why over 70 percent of our low-income members are in Medicare Advantage plans today. We have slightly more than half of the total Medicare members in plans. The total enrollment now leans heavily toward the lowest income members.

Those factors are also why almost 80 percent of our Hispanic Medicare members are now in plans.

The economic inequities and the various social and economic disparities we face over our lifetimes for groups of our people as a nation have created a situation where many Hispanic retirees end up with less than a $30,000 net worth when they retire. Those retirees far too often end up with very little available cash for the expenses of daily living. Medicare Advantage is a special blessing and opportunity for many of those members.

Requiring plans to speak Spanish as a core competency is also very important. It was one of the best, most helpful, and most enlightened things that the people who designed the program did for that set of our people.

Having plans providing dental care for those patients can sometimes be life changing and extremely beneficial for some people who have significant dental pain and mouth related problems that can leave too many low-income people with difficult and painful lives for those issues if they have no way of having that care happen or available outside of their plan.

Those sets of benefits are an extremely good and easily understandable reason why so many millions have joined Medicare Advantage as a program. They’re an obvious reason why extremely high percentages of our lowest income members have joined plans. It’s often their only available care for a wide range of relatively everyday needs and services.

More than half of our Hispanic retirees have no cash reserves to help with their retirement years, so the Medicare Advantage benefits are all golden and the only way some of those services will be in the lives of those retirees.

Medicare Advantage is Now the Best Safety Net in the Country

We need to keep the people at MedPac — who try so hard and so persistently to reduce the benefits for the Medicare Advantage program — to have a heart and a sense of context and to develop some functional and humanitarian insights into real people’s lives and to stop steering their efforts and their influence so persistently toward somehow achieving a reduction in benefits for the Medicare Advantage members.

Too many people will be negatively impacted and directly damaged in their daily lives every single day if MedPac succeeds in those efforts to make those benefits go away or diminish for those patients.

The chair of MedPac wrote and published a piece that seemed to say that cutting benefits wouldn’t be a problem for the country if we look at the actual impact of the reduction across the board. His piece said that people who had money could still pay for those services on their own, and that change in those available services probably wouldn’t affect many people and that those changes were fair to the people who had enough assets for the benefit changes to be irrelevant.

That’s very wrong, unfortunate, and narrow-minded thinking. It needs to be corrected and maybe even retracted.

MedPac Also Needs to Stop Attacking the Quality Program and Blood Sugar Control Goals

MedPac needs to stop attacking the benefits.

MedPac also needs to stop attacking the quality program payments for the plans as well.

MedPac needs to recognize and understand that getting most care sites and most caregivers to perform at higher levels on targeted areas of care is functionally and highly beneficial — not “useless” endeavors with a minimal positive impact on the program, as their recommendation and their quality piece now says.

They also need to look at the actual payments that are now in place for the plans for 2025 and change that language about payment levels for the plans as well. They need to recognize that they should not be saying repeatedly that the plans are overpaid. They should definitely stop saying that the benefit levels need to be reduced and they should stop trying to get the plans to very wrong levels of payment for the people they cover.

They also very much need to stop saying that the real payment level to the plans is currently overstated by 12 percent. They have absolutely no data that they ever show or even hint at to justify that significant number — but they tend to use it in visible and repeated ways to undermine the credibility of the plans with people who are looking at the future of the program and how the plans are paid. They say in their attacks that they want the plans to reduce the benefits they offer, and they propose to achieve that by reducing the plan payment levels below the areas and discounts they’re down to now.

They want to keep people who are thinking about their possible support of Medicare Advantage from understanding how good the program is now for the country. They don’t want people to know that it has better benefits for the plans or to know or understand how much value the quality program has created as a new normal for care improvement for the entire country.

The Medicare Advantage five-star program has created a new culture of quality achievement for the country for many care sites. That culture impact creates long-term benefits for the country at multiple levels when that happens. It creates a new normal for many areas of care that are good for everyone in those settings when the plans and caregivers achieve those goals.

The Medicare Advantage quality program seems to be the only program from any government in the world that explicitly pays more for quality. It’s been extremely successful in making care better for those sites and enrollees in the program. It has a major spillover effect on our entire system of care that reaches far beyond their Medicare patients for optimal care levels.

The plans who achieve five stars make that success a part of their identity. It becomes a sense of organizational pride. They often have public celebrations when they achieve the top ratings. It’s unifying as a goal for care settings and for care teams to have quality wins. It’s relevant and obviously, functionally legitimate as an achievement for those care sites to have that performance happen, and to have it be their new expectation for patient care.

The Five-Star Impact Creates and Reinforces a Better Culture of Care for Many Sites

MedPac has actually asked each year that the quality program be killed. They said a couple of times in their reports that they couldn’t see any value from the quality process for the plans or for Medicare. They never actually describe or discuss the actual elements or components of the program when they attack it repeatedly.

They say they don’t understand why anyone should be paid more for that particular set of achievements. The MedPac people, who looked at the five-star quality program for Medicare Advantage, said they didn’t think the goals for the stars were significant or real.

They’re careful never to mention any functional components of the program or any of the actual goals for the care teams in their attacks. They say that the government should create an entirely different quality program for the plans that would have a bigger impact on care, by somehow being set for a larger number of people and measured on a regional basis rather than by care system. They never give a clue into what that impact or approach would look like in the real world, but they recommend it every year.

All of the people in all of those care sites who had their blood sugar controlled in all of those care settings — who now can actually personally see the world because they saved their vision — would disagree with MedPac’s conclusion that the goals are not legitimate or real.

In any case, it’s extremely important at this point in our political and partisan sets of interactions for everyone involved in the health policy world to realize, understand, and recognize the Medicare program has now been saved at the macro level, and Medicare Advantage saved it.

We Should Focus on Continuously Improving Optimal Care

Over half of the Medicare members are now enrolled in plans. Those plans cost less money than fee-for-service Medicare; and the costs of the plans only increase by 3.3 percent for 2025 at a level that guarantees future gains for those members and a good year for 2025 for the program.

People need to understand why and how that happened.

The total revenue for the entire Medicare program increases by 6.7 percent each year. That trend of having the overall revenue per member increasing at that predictable rate is expected to continue for the next decade. This is extremely important information to know and understand. It creates the business model for Medicare.

It’s clearly the right track for us to be on as a country.

When Medicare Advantage is over half of the members — and when Medicare Advantage costs less money than fee-for-service Medicare in every county — that’s exactly, explicitly, and directly what the Affordable Care Act designed that program to do.

It’s happening and it’s very real.

It gives us a very different political and economic future as a country (for all of our Medicare members) than the one that most people have been predicting, and even fearing, for our future as a nation.

A national Medicare Advantage summit, with some very good participants and speakers, is happening in June of 2024. This information about these issues and about the retirement support realities will be sent to several of the key speakers before the conference. That set of issues and those key points will be featured in one of the talks given to the entire group on the second day of the summit.

We need everyone speaking at the summit to know that they should be celebrating the Medicare success as a huge win for the country.

They should be trying to figure out the next steps for the plans; to give us a future of continuously improving and optimal care that uses the tool kits and cash flow created by Medicare Advantage to help make care better and to help retirees get the support they need at several levels.

Artificial Intelligence Resource Support Might Help Some Low-Income Retirees Get the Services They Need

We need a new set of products and services that fill in the gaps for the retirees with no retirement benefits. Artificial intelligence might create products and life-enhancing services along those lines that will take us to places we haven’t thought about. That could change some lives in very good ways and create a market for some sets of services that aren’t packaged now.

We need to learn how to use artificial intelligence to optimize the care and service configuration for the retirees who need care, but don’t have any money in the bank and need support from somewhere.

Eyeglass benefits need to be protected for people who otherwise wouldn’t be able to see as well as they should. Dental benefits need to be protected for the patients who have dental problems and pain, and no resources or care support. We need benefits that bring dental caregivers into people’s lives when they need them most.

We need to recognize the enormous sets of equity issues that arise when we look at the assets of various groups and make decisions that could strip the Medicare Advantage benefits from our lowest income groups based on bad data and wrong steerage from the critics of the Medicare Advantage program who want lower benefits to be in place.

It’ll be interesting, at the Medicare Advantage conference, to see the wide range of positive things that the plans will be sharing about their future care.

Be well.

See you at the conference.